The disruptions to supply chains caused by the coronavirus pandemic have given supply managers the world over pause for thought.

Now more than ever, businesses must improve the efficiency of their supply chains not only to maintain competitive advantage but also to reduce risk.

Strategic Supplier Management

More broadly, supplier management has become more “strategic” to companies for a number of reasons:

- They produce less than they did in the past, preferring to buy rather than build any category of direct or indirect products and services that fall outside their core business;

- Supply chains are getting longer and more complex. 20 years ago, few western companies would even have considered sourcing materials and components from China;

- The regulatory framework, governing issues such as traceability, is more demanding than in the past in many sectors;

- In an interconnected world, buyers need timely supplier data to drive other processes;

- In particular, all other procurement processes now revolve around and feed into supplier management;

- Organizations need to find the right balance between maintaining low stocks/inventory and avoiding disruptions to operations due to lack of parts etc.;

- Supplier management has become increasingly cross-functional – various stakeholders outside of procurement will have a say for many more categories, requiring collaboration, knowledge sharing, and complex approval processes; and

- Supplier ecosystems are increasingly diverse.

Even though, for the above reasons, we can all agree that supplier management has become strategic, rather than operational, many organizations still rely on ERP systems for supplier relationship management that are (broadly speaking) focused on transactional processing. What that means in practice is a “one-size-fits-all” approach.

Strategizing for a Diverse Range of Suppliers

Given the diversity of supplier ecosystems, this makes no sense at all. But how do you determine to what extent a supplier is “strategic” to your organization?

And in what ways?

With which suppliers do you focus your limited time and energy?

How should you set about differentiating the way you manage suppliers?

Total spend is one way of looking at it, but it soon becomes clear that this does not make much sense. Some suppliers could be mission-critical even though the spend volume is relatively low. An example could be the supplier of an apparently small or insignificant component, without which you cannot produce your end product, and for which one supplier has an exclusive patent.

An extreme example, but you soon get the picture when you consider recent events. And this was underlined when, in the wake of the coronavirus outbreak, Fiat Chrysler Automobiles NV announced that it was temporarily halting production at a car factory in Europe because it can’t get certain parts from China. You cannot manufacture cars with 99% of the components, and if you do not have an immediate alternative source of supply for the other 1%, you could soon be in trouble.

Holistic Supplier Management

The point is that a more holistic approach is needed for supplier management. The amount you spend with a supplier does not necessarily reflect the value it delivers, or the risk posed if there is a disruption to supply.

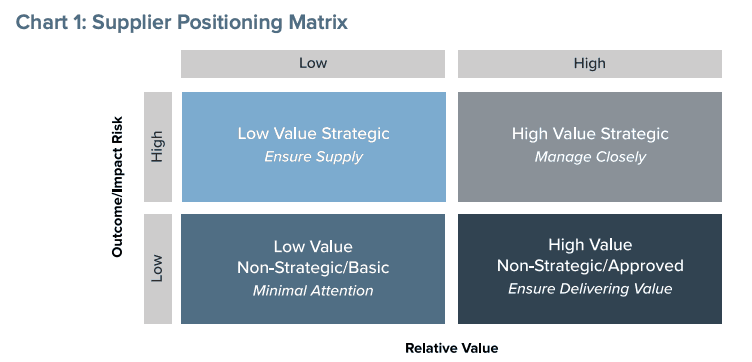

A holistic approach takes account of how individual suppliers fit into the total mix and allows you to manage them accordingly. In our Holistic Supplier Management white paper we suggest using a fairly simple matrix that classifies suppliers across two axes, Relative Value and Outcome/Impact Risk. This puts suppliers into one of four boxes.

Strategic Supplier Relationships

High-Value Strategic Suppliers

Low-Value Strategic Suppliers

High-Value Non-Strategic Suppliers

Low Value, Non-Strategic Suppliers

They can be managed with standard agreements and measures. In fact, in the future, such suppliers will be managed in many cases by means of automated procurement. You just need to track performance and if the suppliers do not measure up you can easily re-source.

A supply chain is far more than a simple combination of purchasing, operations, and logistics. It is no longer sufficient to maintain an efficient supply chain that keeps inventory levels low and manufacturing lean and treats suppliers equally or ranks them based on the volume of spend.