Explore ESG consulting services, data analytics, and monitoring software, plus how to build a strategy using expert insights and integrated management tools.

Introduction: from ESG Strategy to Execution

Companies that embrace ESG set out on a deliberate transformation journey, moving from a risk-focused compliance issue to a strategic tool for long-term value creation, resilience, and competitiveness. This journey requires a fundamental and holistic integration of ESG factors into a company’s strategy, operations, and management systems to achieve sustainable business models and navigate the significant economic and societal shifts currently underway.

In this article we set out some of the milestones on the ESG journey from strategy to execution and continuous improvement, as well as critical issues to be addressed.

Environmental, Social and Governance (ESG) represents a profound shift in how businesses operate, moving beyond traditional models to include their impact on the environment, society, and governance structures. However, this does not imply a departure from profit-centric entrepreneurship. On the contrary, it makes no sense to pursue ESG if it puts economic sustainability at risk. Finding the right balance between ESG and economic sustainability therefore calls for expertise from specialist consultants who can draw up and fine-tune strategies that are adapted to the specific needs of their clients’ business.

In fact, ESG increasingly helps to drive profitability. Placing ESG at the core of their strategy helps organizations attract investment, enhance reputation, gain a competitive advantage, engage stakeholders, and foster long-term value and resilience in a world increasingly focused on sustainability. Research suggests that more than 75% of private market investors plan to invest only in ESG products, making ESG mandatory for many companies looking to attract funding.

What is ESG Consulting?

While some organizations are big enough to have their own dedicated sustainability teams, this is rare. The vast majority will need to invest in external consulting services to develop an ESG strategy. ESG must become a core part of their business strategy, not a separate add-on. Successfully transforming into a sustainable company requires a comprehensive, company-wide approach, rather than isolated efforts, according to both PwC and KPMG, which are leaders in ESG consulting.

Changes to operating models and management systems are required to embed sustainability deeply within the organization. While this requires board-level sponsorship, only an external team of consultants can ensure an unbiased and objective assessment, accelerate implementation, navigate complex regulations, and enhance credibility with stakeholders. Consultants offer unique knowledge of the ESG frameworks that are required to transform ESG from a mandatory exercise into a strategic advantage that improves financial performance, reputation, and long-term value creation.

One of the core services provided by an ESG consulting firm at the start of a transformation project is a materiality assessment. This is the process a company uses to identify and prioritize the ESG issues most relevant to its business and stakeholders. It is unique to the organization and helps it focus resources on the most impactful sustainability topics, align with stakeholder expectations, satisfy regulatory requirements (such as the EU’s CSRD) and build a resilient, long-term business strategy.

The ESG consulting company will engage with internal stakeholders (such as corporate leadership and procurement teams) and external stakeholders (such as investors, suppliers, customers, regulators, NGOs) to understand their perspectives on critical ESG issues. It will provide skillsets and best practices where it identifies weaknesses in the existing structure, either directly or through recruitment and training.

ESG Strategy Development

So, what does ESG strategy consulting look like in practice and what are the deliverables? While different firms will have their own terminology, the service should cover the following steps:

Diagnostic & Baseline Assessment

The purpose of this first stage is to understand the company’s current ESG position and risks. It will cover the review of existing ESG policies, codes of conduct, and supplier standards; stakeholder interviews, materiality assessment and gap analysis against regulatory requirements (CSRD, SEC, ISSB, etc.) and peer benchmarks.

Deliverables include a baseline ESG report (strengths, weaknesses, risks, opportunities), materiality matrix and regulatory compliance/risk gap analysis.

Strategy & Roadmap Design

The ESG consulting company should then translate the findings from the baseline assessment into a coherent ESG strategy aligned with business priorities. Activities include defining strategic pillars (such as decarbonization, supply chain transparency, workforce inclusion, governance) and mapping ESG goals to business value (through cost reduction, risk mitigation, access to capital, market positioning etc.) The consulting firm should also work with stakeholders such as corporate finance to align ESG objectives with financial KPIs and risk thresholds. At this point, it can develop a high-level roadmap with milestones. Typically, this roadmap would have a time horizon of three to five years, with phased initiatives and resource requirements. A further deliverable at this stage could be an executive briefing deck for board or investors.

Policy & Governance Framework

The consultancy firm now advises on how to embed ESG into decision-making and accountability structures. This involves drafting or updating ESG policies (covering functions and topics such as procurement, supplier conduct, diversity, and carbon management). It works with internal management to define roles and responsibilities and to design reporting cadence and governance structures (typically this would include the establishment of an ESG committee with risk oversight).

Deliverables at this stage include an ESG policy framework that internal functions and key suppliers should sign up to, a governance model and a board-level ESG charter or accountability statement.

KPI & Measurement System Design

The team now selects ESG KPIs and metrics aligned with frameworks such as GRI, SASB and CSRD to ensure that progress can be tracked, verified, and reported credibly. It should design dashboards and/or scorecards at a conceptual level (actual implementation comes later, see below). Baseline KPIs should be established and used to set out medium and long-term targets. For example, the medium-term target could be to cut emissions by half by 2030, and the long-term target could be to become fully carbon neutral by 2050.

Supplier & Value Chain Strategy

Given that most ESG issues such as emissions occur in the supply chain, steps must be taken to extend responsibility beyond the enterprise into the supply network. The strategy should segment suppliers by ESG risk/importance. Working with procurement functions such as category management, the ESG consultancy firm will design a supplier code of conduct and compliance processes and develop collaboration programs (for innovation, low-carbon materials economic circularity etc.) A plan would be required for audits to ensure tier-n transparency, and corrective action processes put in place.

Deliverables at this stage include supplier ESG strategy and engagement model, supplier scorecards and risk heatmaps, and partnership frameworks.

Implementation & Change Management

A key advantage of bringing in an ESG strategy consultancy is the impartial help and guidance it provides to move from planning to execution and to get the necessary buy-in. Given that adopting an ESG strategy is a major change in a company’s direction, execution of the strategy will require training and capacity building in functions such as procurement, finance and operations and the integration of ESG into procurement workflows, investment appraisal, and risk management.

Reporting and Continuous Improvement

It is vitally important to draw up and implement a communication plan for internal and external stakeholders. Without this, momentum will be lost. An annual ESG/sustainability report (standalone or as part of the corporate annual report) should normally be the central pillar of communication. The consultancy will design a continuous improvement cycle plan to be implemented by the client company (which may choose to engage the consultancy for annual or periodic audits).

The Role of ESG Analytics and Data

Analytics and data play a central role in turning an organization’s ESG strategy from aspiration into measurable performance. At the most basic level, reliable data provides the foundation for benchmarking against peers, industry standards, and regulatory thresholds. Without this, organizations risk making vague commitments that cannot withstand scrutiny from investors, regulators, or customers. Analytics enables companies to set credible baselines, identify hotspots such as high-emission processes or supplier segments with elevated labor risks, and prioritize interventions where they will have the greatest impact.

Once an ESG program is in motion, ongoing data capture and analysis allow companies to track progress against KPIs, ensure compliance, and prepare consistent disclosures. For example, emissions data can be modelled across Scope 1–3 categories, workforce diversity can be monitored against targets, and sourcing risk can be quantified using supplier performance indicators. Advanced analytics, such as scenario modelling and predictive insights, go further by helping organizations anticipate risks (e.g., future carbon costs or supply disruption) and quantify the financial impact of ESG initiatives.

ESG Monitoring Software & Management Solutions

In short, analytics transforms ESG from a compliance exercise into a strategic capability, linking sustainability performance directly to risk management, resilience, and long-term value creation. But an organization needs to have the right tools in place to do this. The exact choice depends on sector, size, and regulatory exposure, but the building blocks are broadly the same. They can include ESG data and reporting platforms to collect, consolidate, and standardize ESG data across the enterprise and supply chain. Specialist companies such as carbmee can help in areas such as Scope1-3 emissions monitoring.

Data analytics and business intelligence layers can be deployed to turn raw ESG data into decision-ready insights. These can include dashboards for executives and operational managers, predictive analytics for emissions trends, labor risk, or compliance gaps, with benchmarking against sector peers and indices.

JAGGAER as an ESG-Enabling Solution

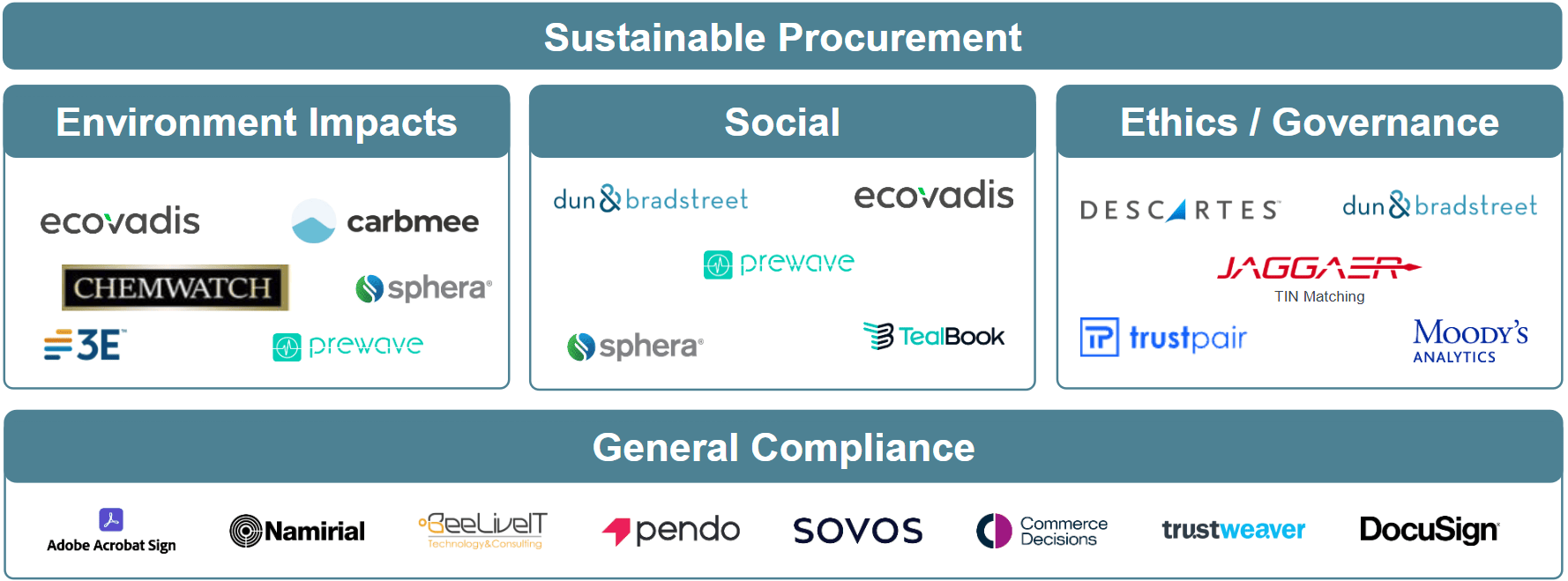

Given that an organization’s ESG impact occurs mainly in the extended supply chain, it is vitally important to have reliable data about tier-n suppliers’ ESG performance. This is where JAGGAER comes in, with its source-to-pay platform and end-to-end supplier intelligence. JAGGAER enables supplier qualification and risk assessments and builds ESG considerations into automated supplier approval workflows. It provides visibility into Scope 3 emissions all the way down to product and transaction level. This is in part through visibility into the customer’s own internal data, but is also enhanced through data streams from partners such as EcoVadis, carbmee, Sphera and TealBook.

JAGGAER also works in close collaboration with ESG strategy consultancies such as PWC and KPMG.

JAGGAER provides the tools and technology needed to embed actionable ESG strategies across your supply chain, for example with category management. When supplier performance falls short, automated development plans are triggered to adjust course in real time. With JAGGAER, you can drive progress at scale with guided, goal-aligned actions tailored to your ESG priorities.

Conclusion: ESG Should Be a Continuous Improvement Cycle

ESG must be treated as a continuous improvement cycle rather than a one-off compliance exercise. It begins with clear strategy definition, supported by expert consulting to translate ambition into policies, KPIs, and supplier strategies. A software platform then provides the backbone for capturing and consolidating data, ensuring that reporting is accurate and auditable. Performance monitoring enables the organization to link ESG outcomes directly to cost savings, risk mitigation, and capital access, particularly across the supply chain, where most ESG impact occurs. Finally, regular strategy reviews based on reliable analytics close the loop by identifying where targets should be adjusted, resources reallocated, or new opportunities pursued. In this way, ESG becomes a dynamic lever for financial resilience and long-term value creation.

Gain ESG visibility across the entire Source-to-Pay process with JAGGAER ESG Intelligence.

Turn Supplier, Risk, and ESG Insight into a Competitive Advantage.