From early on in the Covid-19 pandemic, and for pretty obvious reasons, procurement in healthcare and pharmaceuticals has been in the spotlight like never before. Managing suppliers in a highly volatile economic, societal and environmental situation was especially challenging for the pharma industry. In recent years, the sector has become highly dependent on deliveries from the Asia Pacific region and in particular China, where capacities in the transport chain between inland plants and the ports collapsed by 70% at one point. Some 48 active pharmaceutical ingredients (APIs) vital to the pharma supply chain are sourced from the central province of Hubei. And approximately 70% of APIs from China are shipped to India to produce generics, of which around 40% are then shipped to the United States. In fact, the European Fine Chemicals Group (EFCG) estimates that upward of 80% of chemicals used to make drugs sold in Europe now originate from China and India.

View our recent webinar and learn how Italian pharmaceutical company Angelini navigated through supply chain disruption.

How can companies mitigate such supply risk? While the pandemic is unlikely to shift pharmaceutical supply lines in a fundamental way any time soon, pharma executives agree that Covid-19 marks a turning point in public understanding of supply risks and will fuel efforts to establish local supplies of chemicals and APIs as a matter of national security. Evonik, for example, announced a major shift of API production to Germany in May and is reorienting its global network of contract manufacturing organizations (CMOs) to reduce reliance on Asia Pacific.

Supplier management is, of course, challenging at the best of times, and for a variety of reasons. These include the difficulty of maintaining information that is complete, correct and up to date. Because supplier information comes from a variety of sources, it is difficult to get a holistic view into the entire supplier portfolio. What’s more, supplier management information is often inadequately integrated with supply chain planning systems. Organizations typically have limited resources to execute risk programs and a lack of insight into any external risk events, let alone something as unforeseen as the Covid-19 pandemic.

Technology and Best Practices Make a Difference

What has become very clear over the past few months is that companies that had digitally transformed their sourcing and procurement processes achieved better performance to manage suppliers through the crisis, which has unfolded over three stages.

First, companies were challenged to absorb the shock, taking whatever measures they could to minimize the damage. Organizations with technology and best practices in place were better able to grasp the situation and act to secure supply. Most set up task forces to manage supplier and supply chain risks and used feeds into dashboards to assess suppliers and manage supply and shortages of external labor.

What major challenges have you experienced due to the current global volatility?

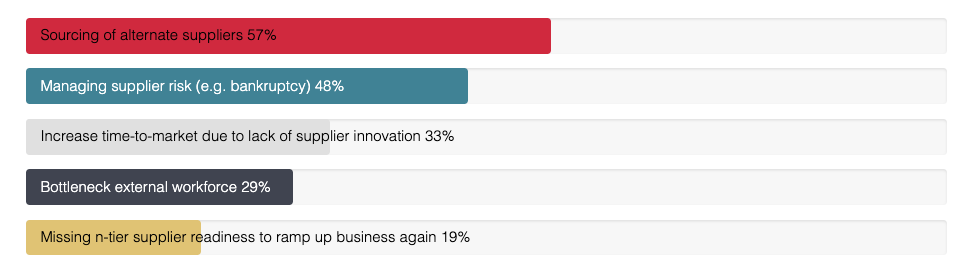

Second, over the medium term, companies needed to manage risk measures to endure through the crisis. These measures include identifying single source and supplier risk, ramping up alternate logistics, securing supply and increasing stock levels, and sourcing and onboarding alternate suppliers, if necessary providing financial and other forms of support. According to the poll we conducted in our recent webinar, sourcing alternate suppliers was the biggest headache faced by procurement professionals in pharma, cited by 57% of participants. The strict regulatory environment in which the pharma industry operates makes this doubly difficult for key suppliers of categories such as APIs and primary packaging, so it is a good idea to have a pool of suppliers in place that have been fully audited and qualified in advance for necessary compliance.

Create a Risk Portfolio That Is Broad and Deep in Scope

Supplier risk (e.g. bankruptcy) was also cited as a major challenge by 48% of the webinar audience. Frequent and regular communication with strategic suppliers is always important but far more so when they are facing many unseen challenges. Organizations that have succeeded in creating an environment of openness, in which strategic suppliers are treated as partners, will be much better placed to manage the risks and get early warning of potential problems.

Companies are also advised to create a risk portfolio on their suppliers based on the probability of failure and its impact and manage accordingly, with a readiness to support key suppliers through difficulties if necessary. This should look beyond financial risk, modeling the various operational risks such as disruptions to transport networks – and not just the inherent but also the residual risks. The JAGGAER solution suite enables pharma procurement teams to gain the visibility, insight and transparency into their supply base so they can reduce risks and uncertainty.

Of course, on both of these issues, visibility into data – both internal and from third parties – makes a huge difference.

Other issues mentioned were increased time to market due to poor levels of supplier innovation (33%), bottlenecks in the external workforce (29%) and n-tier supplier readiness to ramp up business again.

Finally, over the long term, as the situation stabilizes and companies restart business-as-usual activities, procurement teams need to assess the damage and, having paused for breath, learn from the experience. They are advised to carry out a thorough risk assessment and adjust their supply chain management risk operating model and procurement strategy. By assessing your supply base readiness and considering second and third tier suppliers you will be in a much better position to cope with the next shock.