Catch up on Part 1 here.

Part 2 – Levers for building supply chain resilience

I recently had the pleasure of hosting a webinar with Dr. Matthias Mette, Principal at our partners h&z Management Consulting, and a leading authority on supply chain and procurement transformation. The topic was supply chain resilience.

In the first article I set out the factors that demand a more robust approach to building supply chain resilience. In this second article I discuss some of the measures needed to do this, as presented by Matthias.

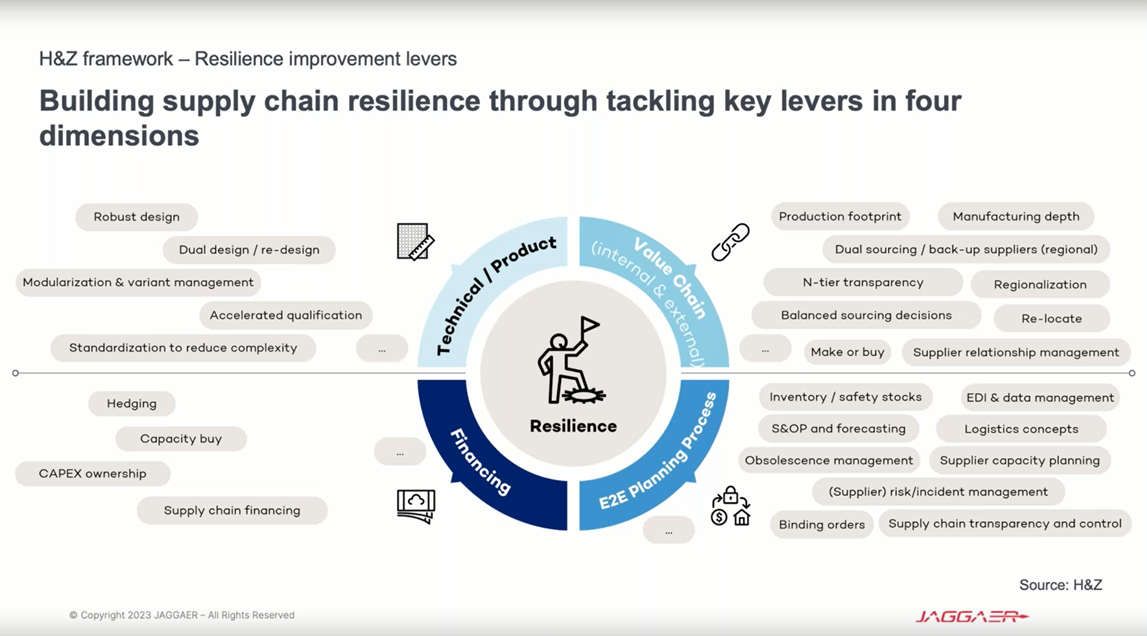

So, what tools or levers are available for building supply chain resilience? There are many, so it makes sense to categorize them under four broad headings or dimensions: Technical/Product, Value Chain, End-to-end Planning Process, and Financing. Some examples will help to explain how these levers operate.

Technical/Product: Resilience can be “built in” to the supply chain already at the design phase, for example by removing complexity and relying on standards, not just in your own final product design but also in the inputs, such as tool design, enabling you to use alternative materials from different suppliers. What you do in the R&D stage has an impact on your flexibility and therefore supply chain resilience. Stating this is nothing new but, for the reasons set out in the first article, it has become more important than ever.

Value Chain: Levers that are available here include building transparency beyond your first tier suppliers, as problems are just as likely, or even more likely, to arise further down the value chain and you must have options should they occur. Other strategies include dual sourcing, regionalization strategies (e.g. nearshoring and friendshoring), relocation, decisions to make rather than buy key components etc. Above all, this is where strong supplier relationship management pays off, through collaboration, information sharing and planning with a view to early identification of risks such as shortages.

End-to-end Planning Process: Further resilience can be achieved through the capacity to put cross-functional teams together relatively quickly when disruptions arise, extending from sales and operations, who, among other things, have access to vital information in their demand forecasting and planning, through manufacturing and supplier management to procurement. Data quality and sharing across the enterprise is vital here – effective decision making relies on all of these functions having access to a single version of the truth; in order to determine how things should be in order to optimize resilience, you must first know where you actually stand right now.

Financing: Especially in times of inflation, supply chain resilience rests on financial flexibility. Supply chain resilience cannot exist without the freedom to allocate resources not only to respond to disruption but also to adjust quickly once the disruption has come to an end and its impact receded, investing in future growth. You cannot afford to allow valuable working capital to be trapped in the supply chain; on the other hand, pushing that burden onto suppliers weakens supply chain resilience and incurs costs. Various instruments are available to avoid this pitfall including hedging strategies, buying capacity, CAPEX ownership and supply chain financing. It’s important that your CFO and investors understand the issues and the possible impact on cash flow optimization, and that they provide options to free up cash that would otherwise be trapped within the supply chain while also enabling suppliers to get paid early, increasing their own resilience.

Can supply chain resilience be quantified?

In recent years we have seen how non-financial metrics can be quantified and indeed monetized. Sustainability measures such as carbon footprint are a good example. Can the same approach be applied to supply chain resilience? The answer is yes, but as yet there is no generally accepted measure. It’s a work in progress. “Spend at risk” is one method that is often referred to. How much of our spend is with a single-source supplier? How much are we spending in high-risk countries? What is the cost of a disruption, based on what has happened in recent years? Thus, there are ways to approach the topic and bring supply chain resilience KPIs and scenario modelling into cost and performance scorecards. Eventually this must happen because it will provide a much more reliable basis for making decisions on supplier management strategies, taking into account not only price but also total costs including risk, alongside other factors such as sustainability. Some companies have already made progress in this direction.

What we must learn to accept, however, is that resilience does not come cheap. It’s an investment. There is a cost when you diversify or change your suppliers in pursuit of resilience or apply some of the levers mentioned above such as reducing complexity in the design phase, and it is therefore necessary to build a business case for doing so. This business case must cover all aspects, not just cost. For example, reducing design complexity can be leveraged to bring benefits such as introducing greater sustainability. Like any other business case you need to look at resilience in the round, that’s to say as an investment that has costs but also has the potential to bring a variety of financial and non-financial dividends. Unfortunately, many CPOs only see the costs and that has to change.

Resilience as a source of competitive advantage

For supply chain resilience to be perceived as an issue for senior leadership we must go even further and demonstrate that it not only prevents or mitigates disruptions but also serves as a source of competitive advantage. Let’s take an example. Recent studies have shown that consumers say they have diverted, or will divert, their spend to more sustainable, more diverse or more eco-friendly vendors – in some cases even if this means additional expense. The tendency is more pronounced in certain demographic segments. Sales and operations managers, who have insights into how these trends affect their own revenue streams, will be keen to capitalize on them, but to do so they rely on procurement’s ability to shift to more sustainable or diverse sources of supply.

Supply chain resilience can thus become a factor in product differentiation, and when this is the case, it ceases to be a topic that is only of concern to procurement and supply management. It becomes an issue for the boardroom, and in turn it must become an issue for R&D, product design, engineering, and sales – the entire end-to-end planning process mentioned above.

Likewise, the capacity to respond to geopolitical factors with greater agility than your competitors, for example through rapid regionalization of suppliers of EV batteries or microchips in lower risk countries, thereby reducing dependencies, can bring cost advantages even if the manufacturing costs of the new suppliers are actually higher.

Final thoughts – key takeaways

Supply chain resilience is an exciting and rapidly evolving science that will become increasingly data-driven in the years to come. For now, we can summarize Matthias’ fascinating presentation of the topic with five key takeaways for procurement and supply management professionals:

- Fight against pushback: make a strong business case for investing in supply chain resilience capabilities.

- Pursue the right balance: go beyond your traditional sourcing decision criteria, giving supply chain resilience equal weight.

- Don’t play power games against strategic suppliers: today, it’s a team sport and collaboration is your ace and not just with Tier 1 suppliers.

- Sell a compelling story to your CEO: show the interdependencies and the topline benefits. Be the driver of a transformation that brings competitive advantages.

- Focus on the enormous upside: waste and unnecessary complexity will become transparent, contributing not only to greater resilience but also to lower costs and a more sustainable business.