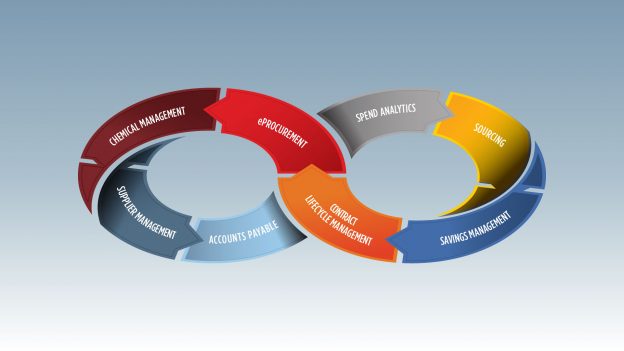

JAGGAER has a unique three click purchasing experience that stands at the pinnacle.

While companies like Amazon, eBay, Alibaba, and PayPal changed the consumer experience with their B2C platforms other eCommerce companies have thrived in the B2B space. There is a big distinction between the B2C and B2B, but there are advocates making the case that the two are converging. We believe exactly the opposite based on a simple, yet fundamental difference in the B2C and B2B schools of thought: consumer purchasing is a shopping experience whereas business purchasing is a buying experience.

Let’s define some shopping and buying characteristics.

| Shopping | Buying |

|---|---|

| Is Behavioral | Is deterministic |

| Is Liability | Is Asset |

| Feels good | Is Required |

| Is Personal | Is Organizational |

| Brand Driven | Quality Driven |

| Warranty Driven | Dependability Driven |

| It’s not Strategic | It’s Strategic |

| It’s Cold | It’s Relationship |

| Ease of use is Very Important | Ease of use is Very Important |

Consumer and business eCommerce sites are different! Typically, consumer shopping sites are either owned by the suppliers/Retailers/Distributors or by exchanges like Amazon, Google, and Alibaba. However, there are two different strategies on exchange model. One serves as a medium for merchants to use the technology, whereas the other competes with them too.

Business exchanges like JAGGAER use multi-point network topologies (star like network) to facilitate collaboration in the supply chain, establishing a truly connected network versus consumer sites that runs point-to-point transactions (bus like network).

Consumer eCommerce Model

Suppliers/retailers/Distributors spends tremendous amount of resources collecting market intelligence to understand shopping/spend behavior of their customers to enable their market strategy and sourcing plans. Using a massive repository of the spend data and converging a universal taxonomy and leveraging an advance analytics tool would generate the optimum demand signal for any marketing organization to forecast accurately. Most organization have challenges to rationalize their own data due to lack of data governance, quality and compliance. Many of them acquire the services of technology partners to achieve the desired classifications and rationalizations to understand the descriptive (what happened) part of their data. Further investment into predictive (what could happen) and prescriptive (what to do) has proven little to no benefits where signal quality is not sufficient enough. However, that does not stop organization building massive analytical groups to investigate big data projects.

As mentioned above the exchange models where, the technology service provider is also a competitor creates a very different and interesting landscape. This model is a facilitator and competitor.

As a distributor/supplier of electronic, household, or any other commodity products selling on one of these facilitator and competitor exchanges, it is important to understand the total spend through the site for similar products and the market share in comparison to other competitors including the solution provider in time. The analysis based on high margin products in time would be an interesting graph to visualize.

I am not convinced that we all will shop from a few major exchanges and the resellers and distributors will go away. However, I can anticipate these type of exchanges will mutate to be more like a retail and follow their strategy by developing their own brands and manufacturing capabilities. Nevertheless, it will change the strategy of distributors and resellers by providing additional values and services and focusing on niche markets.

Even though we have digressed from the main topic but it is important to understand the eCommerce strategies among exchanges of B2C and B2B.

3 Actions Needed in Business eCommerce that are different than the Shopping eCommerce!

If we do believe there is a difference between shopping and buying, then we need to make sure the ease of use is not the differentiator being used to distract the business decision makers from the true value and therefore the divergence not convergence of the B2C and B2B.

There are three actions that need to be streamlined and fully optimized when a request is identified. I refer to it as FPP. Find what you want, Pick and place it into your basket, and finally Pay for it. For an analytical based eProcurement solution, each of the three steps has to be engineered to deliver the optimum result based on each vertical.

Define your needs and then;

- Click 1 – Find: How do you find a product/service?

- Click 2 – Pick: How do you pick the right product/service from many options?

- Click 3 – Pay: What’s your payment optimization process?

Find

Let’s not confuse ourselves between find and search. One searches to find, not the other way around. There are many ways to find what you need. Search engines have devoted tremendous amount of technology to help us access big data faster. It’s the solution provider responsibility to utilize the search engine and provide the right content at the right time using multitude source of information: such as contracts, partners’ catalogs, organization guidelines, historical orders, incentives, custom templates, Kit dependency, shipping, tax incentive, and many other sources of relevant content. The result should be intelligently curated and ranked for the optimum requirements.

Pick and Place

A buying solution should provide guidance to what’s the best choice and why. It should alert and warn the user if the best choice is not selected. It should direct the user to additional libraries in the supplier content management websites or commerce. Risk analysis and risk mitigation including supplier performance is not a static analysis and it should dynamically assist the buyer. Justification for some selection has to be intuitive with material evidence and documentation to fulfill the organization guidelines.

Pay

The relationship between client and supplier should be predefined. Terms and conditions of payment including dynamic discounting is part of selection criteria and not post processing. Payment optimization is beneficial to both party.

In conclusion, one solution does not fit all. We need to understand the need of our customers and drive values to the entire supply chain including buyer and supplier. Building relationship and partnership is the only way to succeed. JAGGAER realizes you might be able to move to adjacent verticals but each one has its own unique requirements and they need your full attention and commitments.

How much opportunity is gained if we could use a point or two adjustments in our annual spend using intelligent buying solution? Come and see us to show you what we are doing and how we can get there together.