Guest article by Prof. Christian Heinrich, Co-Founder and Managing Director, carbmee

The 80% Challenge

I was recently delighted to participate in a JAGGAER live webinar focused on the introduction, in recent years, of carbon emissions measurement as a factor in strategic sourcing. The objective of net zero carbon footprint is now familiar. Most large companies have it embedded in their ESG strategy but beyond that, they understand that carbon emissions cost money. Consequently, all departments in the company are tasked to reduce emissions. In a manufacturing company, this will typically be between ten and twenty percent of emissions falling under Scope 1 (direct emissions that are controlled by a company) and Scope 2 (emissions that a company causes indirectly, for example as a result of its consumption of electricity). But that still leaves the other eighty percent of emissions that fall under Scope 3 (those that the company is indirectly responsible for up and down its value chain).

Procurement professionals, who buy in these goods and services from n-tier suppliers therefore face what I call this “Eighty Percent Challenge”. Procurement professionals re in the driving seat in the pursuit of net zero and they are the ones that need to provide evidence of progress across those 80 percent of emissions. Why? Well partly because it’s what the public demands but more urgently because carbon accounting impacts a company’s valuation and future prospects Thus carbon reduction has significantly expanded procurement’s traditional mandate to deliver cost reduction, quality assurance and efficiency with this new dimension. In short, the cost of carbon needs to be integrated into buying decisions, and this has an additional positive aspect in that, as we will see, procurement must be more closely involved in new product development to create low carbon, environment-friendly products.

The regulatory environment – CBAM

Carbon accounting is also required under increasingly stringent regulations, notably CBAM, the Carbon Border Adjustment Mechanism. CBAM is a carbon tariff on six carbon intensive product categories: hydrogen, iron, steel, aluminum, electricity and fertilizer, which are imported to the European Union. It forms part of the “European Green Deal”. CBAM takes effect in 2026, with reporting already required from 2023. It provides an incentive for buyers to source from low-emission suppliers, and therefore also provides an incentive for suppliers to invest in carbon reduction measures. If you don’t comply with CBAM reporting requirements, you risk losing your license to operate. Also from 2026, importers of products included in the six categories will begin to pay a border carbon tax for their products based on allowances in the European Union Emissions Trading System. Further categories will be added year on year, starting with plastics.

Moreover, this has implications beyond the EU. Non-EU producers will be connected to the whole system to ensure that CBAM is fair and does not discriminate or lead to trade disputes under World Trade Organization rules.

Data transparency

Data transparency will be essential to carbon accounting. And in this context, transparency means full visibility on the origins, processes, and environmental impacts of goods and services throughout the supply chain. It’s not enough to send out questionnaires to suppliers; companies must identify the Scope 3 carbon hotspots in their operations and calculate the carbon footprint of their suppliers on a transactional level (as opposed to high-level Carbon Disclosure Project metrics, which are known to be around 30 percent inaccurate) and confront them with the findings to incentivize reductions. Of course, data transparency (and carbon taxes) will also make it far easier for procurement to defend purchasing decisions that are influenced by emissions considerations.

Strategies for Scope 3 reduction

Strategies for Scope 3 carbon reduction fall under two main headings.

First, supplier collaboration: You need to engage with suppliers to identify opportunities for emissions reduction and implement joint initiatives. Very often these are easy to identify and act upon. Find the top hotspots and incentivize suppliers to switch to green energy sources. In that way they reduce their Scope 1 and 2 emissions, which is good for them, and you reduce your Scope 3 emissions, which is good for you.

Second, eco-friendly product design: This means designing products with lower environmental impacts throughout their lifecycle, from sourcing raw materials to end-of-life disposal. To take an obvious example, it is better to design a car that uses sheet steel produced from low carbon producers than it is to buy from a consumer of non-green energy sources and subsequently trying to persuade them to switch.

Carbmee is currently involved in providing the data for more than 50 Scope 3 carbon reduction initiatives along these lines.

From data to insight to action

Having the data is one thing. However, many organizations are “data rich but insight poor”. So the next question is how to integrate carbon data into a purchasing platform like JAGGAER. Unlike other areas of ESG, which often involve simple decision-making, even at the box-ticking level, carbon management is extremely complex.

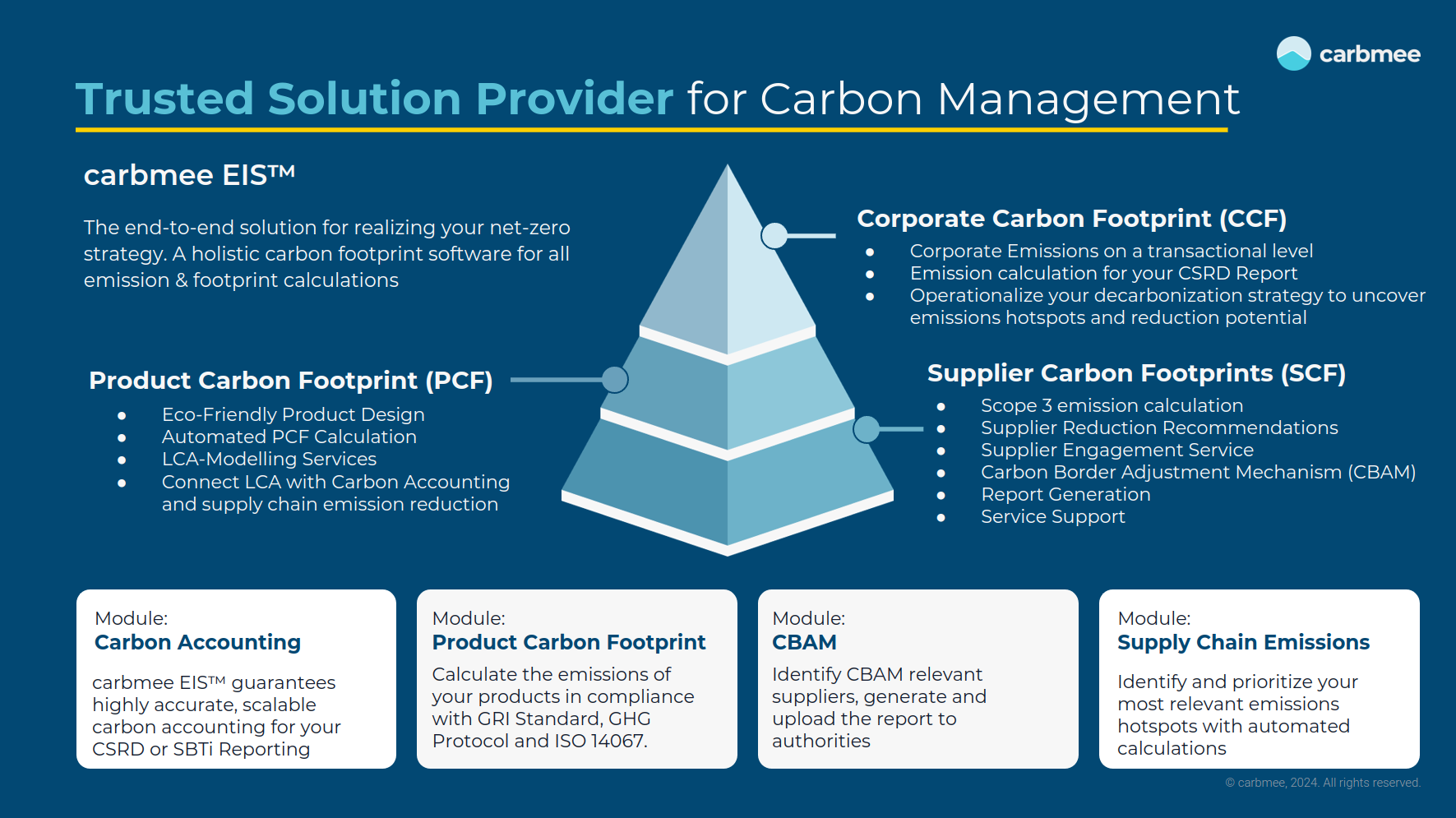

In doing this it is really important to have a holistic and integrated model that uses the same metrics for supplier carbon footprint (SCF) and product carbon footprint (PCF) to get an accurate picture of corporate carbon footprint (CCF) Scope 3 emissions – and it is now necessary to do so in any case for CBAM. This is essentially the model we have built with carbmee EIS™ (see Figure 1).

Figure 1: Carbon Management with carbmee EIS.

Learn more about Strategic Sourcing and Decarbonization in our on-demand Video: Watch now

This is the first of a two-part series. In the next article, JAGGAER Vice President Direct Procurement Strategy Georg Roesch will look at best practices for integrating carbon management into your procurement strategy.