What Is Strategic Sourcing? A Complete Guide

Strategic sourcing is a data-driven approach to securing the best value for your organization from its strategic suppliers. The process creates efficiencies across all spend categories, minimizes supply chain risks through improved supplier selection and awards, while giving visibility into pricing and forecasting. In the end-to-end source-to-pay (S2P) process, strategic sourcing is the link between spend analytics, category management and contracts management, and is supported by supplier intelligence.

It is called “strategic” because it replaces traditional ad hoc approaches to sourcing, which were almost entirely focused on cost savings, item by item. Strategic sourcing formalizes the gathering, analysis and application of information to align purchasing strategies with the organization’s broader goals while securing the best possible overall value.

Which Suppliers Are Truly “Strategic”?

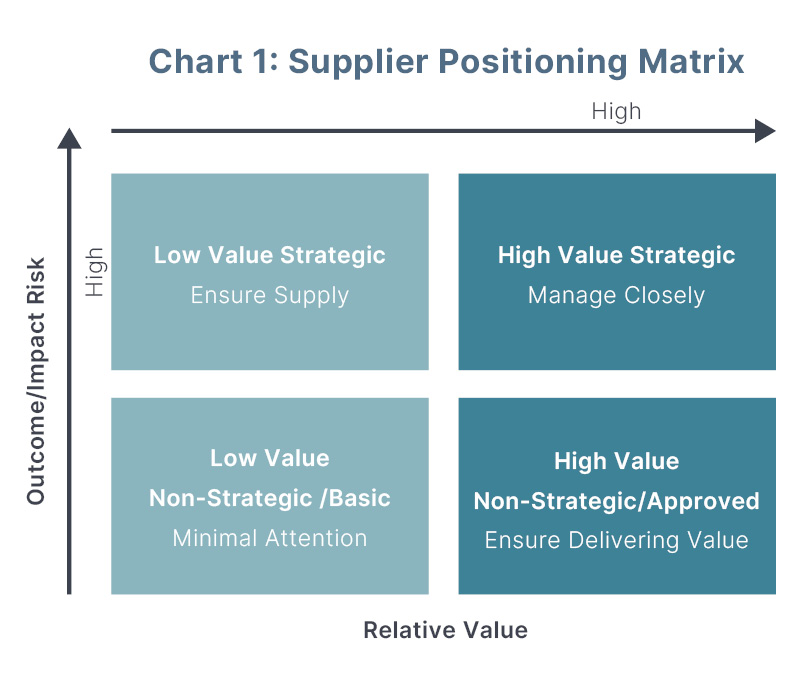

Even the largest organizations have limited time and resources. Strategic sourcing makes sense for suppliers that are of strategic importance to your organization. You probably would not want to waste time and effort strategically sourcing your paperclip supplies, for example. So which suppliers are truly strategic? And in what sense? The answer is not immediately obvious. One way of looking at it is to place all of your suppliers in a matrix, with “Relative Value” along one axis and “Outcome/Risk” along the other:

The suppliers that require closest attention in the sourcing process and also close management after selection are those that are both high value and of strategic importance to your operation. Your focus here is to get security of service at a good price. That means negotiating a medium to long-term contract to support security of supply and having a contingency plan in place in the event of problems.

With low value strategic suppliers, such as the supplier of a strategically important but low-cost component such as a microchip designed to do one specific job, the focus is on ensuring continuity of supply. Typically, there are few suppliers, so you are likely to source from a vendor that you can be sure is reliable and you negotiate long-term contracts to support security of supply. In such cases, finding an alternative supplier could take a year or more. Maintaining a close relationship allows you to address issues proactively, and as part of the sourcing strategy, you may even help the supplier expand their capacity. The lowest price, in this instance, is not the end goal of negotiations because the cost of the goods/components is low relative to your overall costs of production.

Approved suppliers – in the bottom right quadrant – deliver high value, but they are non-strategic. If they cease to be competitive, or reliable, you should consider re-sourcing. Shorter term contracts will enable you to re-source to achieve better value and/or to get a better price. For instance, a basic ingredient for a food or drinks product such as sugar or butter. These represent a high-value input to your final product, but there is little differentiation between one supplier and another and there are plentiful alternatives on the global market.

Finally, in the bottom left we have basic suppliers, or your tail spend. Suppliers of low-value, low-risk products and services can be sourced and then managed on standard short-term agreements, with standard measures, monitoring and reporting. In these categories there are plenty of alternative sources. But given that these are not categories involving high spend, you should only consider re-sourcing if your suppliers fall below average standards and outcomes or there is an opportunity for savings by finding a cheaper source.

Category managers should understand where suppliers fall within this framework and provide the necessary data and insights to support strategic sourcing.

Strategic Sourcing Is Smart Procurement

Strategic sourcing is thus a smart approach to procurement because it considers each sourcing project to be unique based on analysis, insight and knowledge of the marketplace. Traditional sourcing focuses on high volumes and bulk buying to secure discounts. However, pricing is only one of many factors in strategic sourcing, which focuses on securing the best quality for the lowest total cost or cost of ownership. The word “quality” here covers a range of considerations contributing to value in every aspect of a company’s operations. For example, a confectionary manufacturer may select packaging suppliers not based simply or even primarily on prices but rather based on factors such as design services, speed and flexibility as well as other considerations such as hygiene, regulatory compliance, location and commitment to sustainability.

In short, whereas traditional procurement judged the importance of suppliers and supplier categories based on price and the volume of spend, strategic sourcing considers a range of other factors. That tiny widget might only account for less than a thousandth of a percentage of your annual spend, but if your operation grinds to a halt because it suddenly becomes unavailable – well, you’ll soon appreciate that it is truly strategic. You simply must ensure reliability of supply.

The Building Blocks of Strategic Sourcing

While strategic sourcing will differ based on industry, business objectives, competitive positioning and much more, we can identify several essential building blocks that will be common across most companies.

- Spend Analytics – Strategic sourcing starts with an analysis of product categories and spending patterns within the company. Sourcing professionals must consider the departments involved, the quantity, where they are located and the processes that are used.

- Market Analysis – The sourcing team conducts a review of the supplier market for the spend category in question. Access to a database of supplier intelligence is crucial to getting the full picture. Analysis should be focused on risks and opportunities while factoring in all costs and sources of added value. Draw up a portfolio of suppliers – incumbents and alternatives.

- Stakeholder Engagement – Present your supplier portfolio to stakeholders (decision-makers and influencers) from the relevant business functions. Determine which of the suppliers best align with their goals and the company’s mission and objectives.

- In-depth Research – Conduct in-depth research on potential suppliers, including interviews and, where appropriate, site visits. Request proposals based on your specifications (e.g. cost, products, legal terms, logistics etc.) Draw up selection criteria optimizing outcomes against risk.

- Selection – Review and compare the proposals, asking for clarification where needed. In some categories it makes sense to conduct a competitive sourcing event, for example an online auction using eSourcing software. For complex categories such as transport and logistics (complex because there are often multiple potential transport lanes) you will need to work on scenario analysis requiring more sophisticated software.

- Award & Onboard – At the end of the selection process, you will award the business to one or more suppliers. While the contract management team will take over any final negotiation of terms to create a cast-iron contract, there is still work to be done by the sourcing team. The suppliers need to be onboarded into your systems. And thereafter effective communication will be vitally important, especially as unforeseen changes in requirements are likely to occur.

- Monitor & Review – Finally, you must continuously monitor supplier performance and provide ongoing feedback to ensure that suppliers are meeting contractual obligations, and the optimum value is achieved. The team should carry out periodic reviews to help fine-tune strategic sourcing and provide input into future sourcing events.

Maximizing Value Through Continuous Improvement

The role of strategic sourcing doesn’t end once the contracts are signed. Procurement and supply chain teams work together to maintain strong supplier relationships, track performance, and identify opportunities for continuous improvement. Continuous improvement can be achieved over the years through a supplier intelligence feedback loop. Strategic supplier management is critical for sourcing teams not only to understand which partnerships are delivering on their contractual obligations, but also where there are gaps in the sourcing strategies themselves. In recent years unforeseen supply chain disruptions have forced companies to identify and plug these gaps at short notice. Knowledge of global supplier markets is essential to minimizing risks to avoid or mitigate operational disruptions.

Strategic Sourcing and Digital Transformation

The transition from traditional procurement to strategic sourcing could not have occurred without the digitalization of the source-to-pay process and the development of dedicated sourcing apps. Without these tools, choosing between different suppliers can be like comparing apples with oranges. And yet it is still not uncommon for large enterprises to be using a clunky combination of legacy ERP systems, spreadsheets, email, and written reports to conduct their sourcing activity. This makes it virtually impossible for cross-functional teams to communicate or to monitor and measure supplier performance. Without a digitalized sourcing process, companies also struggle to match their competitors both in terms of reducing costs and achieving optimum value from suppliers.

These shortfalls became especially painful for many companies that were not ahead of the curve on digitalization during the Covid pandemic and other supply chain disruptions such as the Suez Canal blockage.

With increasing complexities and interdependencies in supply chains, strategic sourcing teams require ever greater visibility beyond tier one suppliers into the extended supply chain. Not only to reduce the risk of disruptions but also to ensure that their companies are operating in compliance with company policies, national and international regulations and ethical standards.

Sophisticated eSourcing software make it possible to achieve optimal supplier selection in even the most complex categories. Strategic sourcing teams are empowered to align complex decision criteria, weighing cost and availability against risk, social responsibility and business value to arrive at a perfectly tailored decision. With the right technology, you can cover all sourcing scenarios, strengthen supplier relationships, and be confident of continuous improvement from one round of sourcing to the next. Whether successful or unsuccessful in bidding events, suppliers also benefit from the communication and feedback made available through eSourcing events.

Organizations that empower their strategic sourcing teams with advanced technology are building stronger relationships with suppliers, greater cohesion within and across internal cross-functional teams, and better alignment between procurement and the mission and objectives of the business.